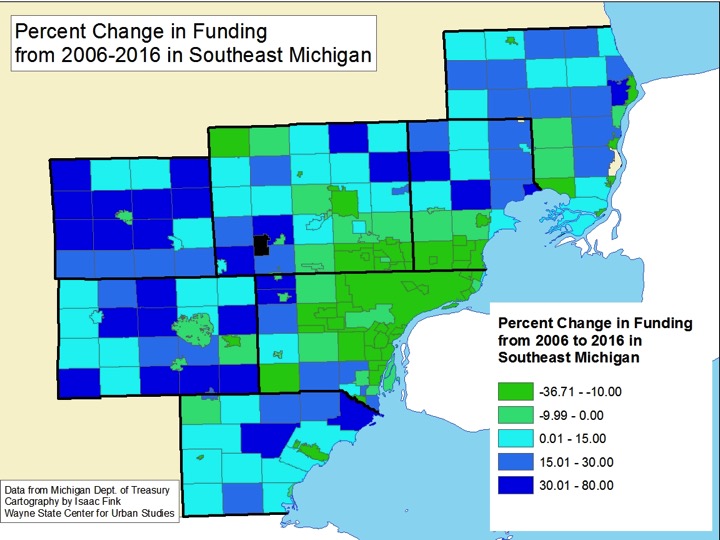

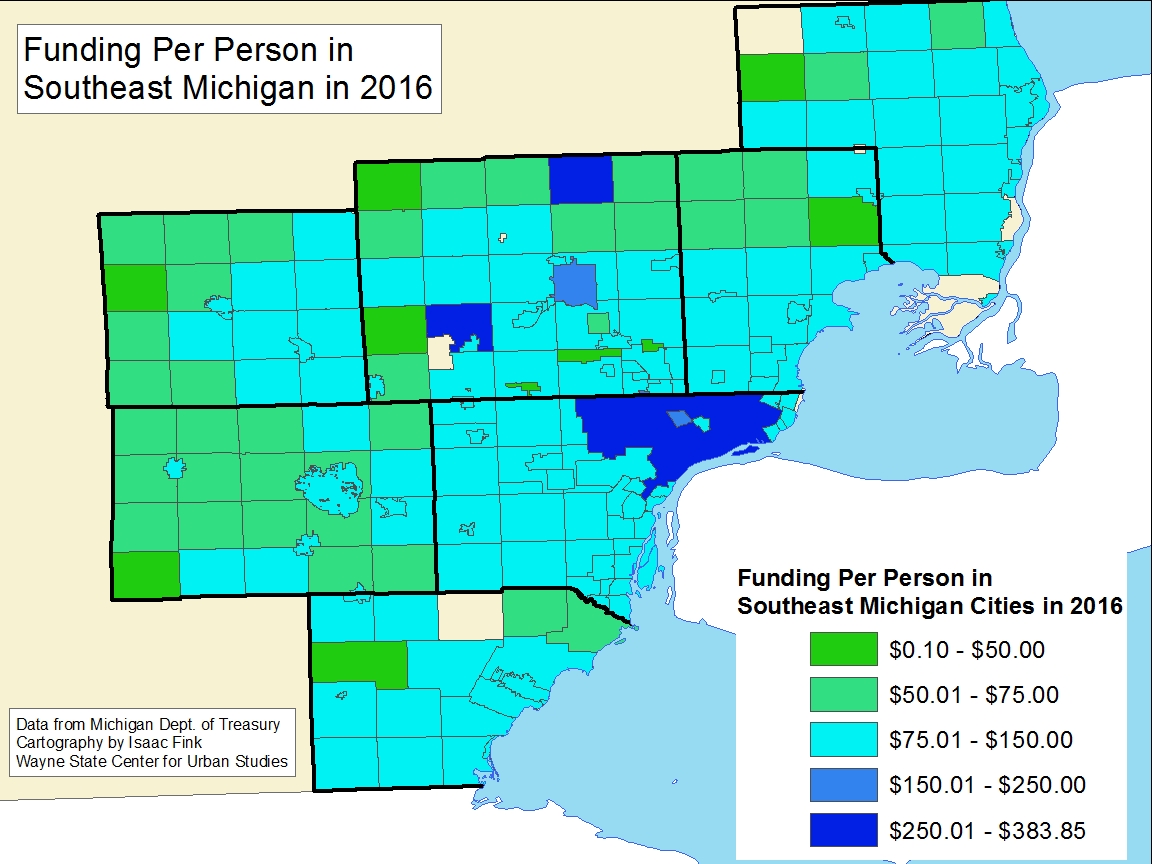

In comparing total Revenue Sharing Funds distributed throughout Southeastern Michigan between 2006 and 2016 we see that the city of Detroit, and those surrounding it, have suffered the most significant loss in Revenue Sharing Funds.

The City of Detroit experienced a 31 percent loss in total Revenue Sharing Funds between 2006 and 2016, without adjusting for inflation. This loss was the second largest in the region.

As discussed in our previous post, total Revenue Sharing in Michigan combines two payments, one for Constitutional Revenue Sharing and one for Statutory Revenue Sharing. The Constitutional Revenue Sharing formula is part of the State’s Constitution while Statutory Revenue Sharing formulas are subject to regular legislative modification.

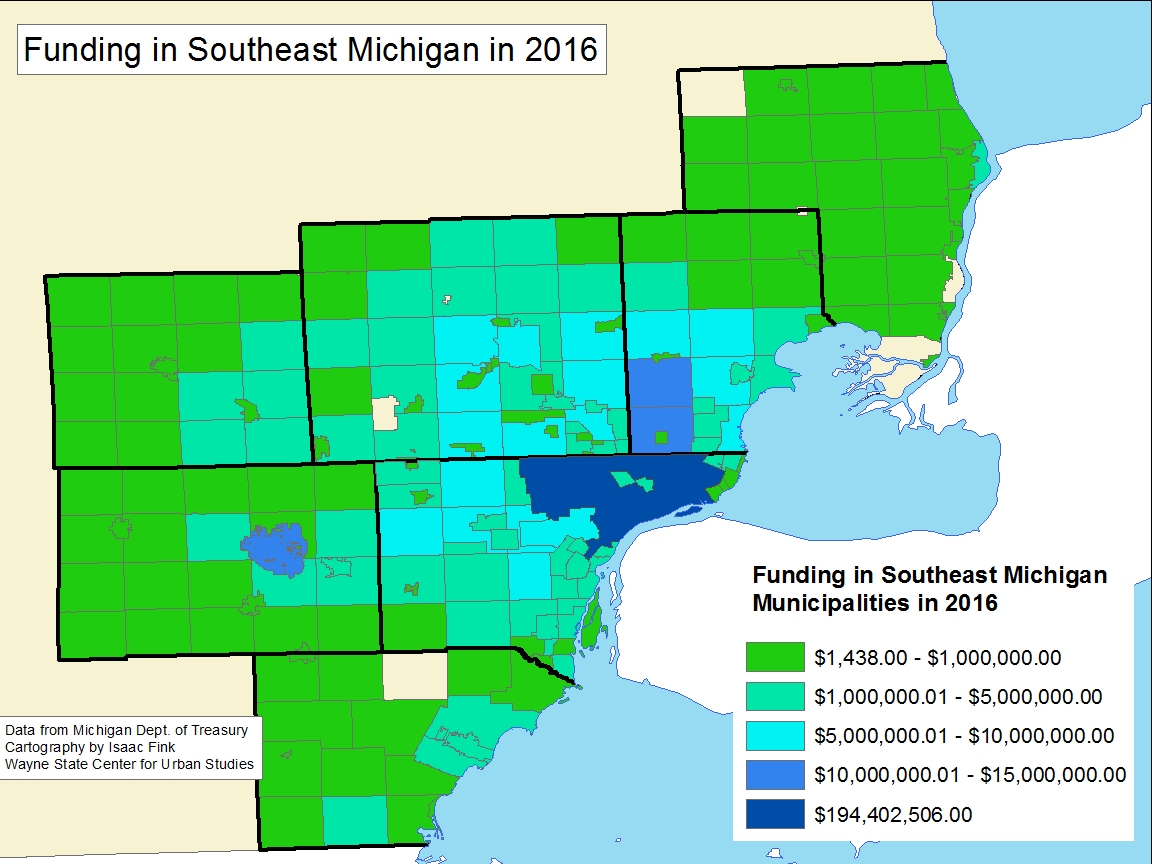

In 2006 the City of Detroit received $281,074,148 in total Revenue Sharing Funds and in 2016 that number was $194,402,506, without adjusting for inflation. When adjusting for inflation at a rate of 19.5 percent the funds Detroit received in 2006 are equivalent to $335,883,607 in today’s dollars. This means there is a $141,481,101 difference between the amount of total Revenue Sharing Funds Distributed to Detroit in 2006 and 2016.

As noted, Detroit and the municipalities surrounding it experienced the largest decreases in Revenue Sharing Funds when comparing 2006 and 2016. In Livingston County we see that only two municipalities-Fowlerville and the City of Howell-experienced a decrease in the amount of funds distributed to them when comparing 2006 and 2016. Every other municipality in that County experienced an increase between 3 percent (City of Brighton) and 68 percent(Marion Township), without adjusting for inflation.

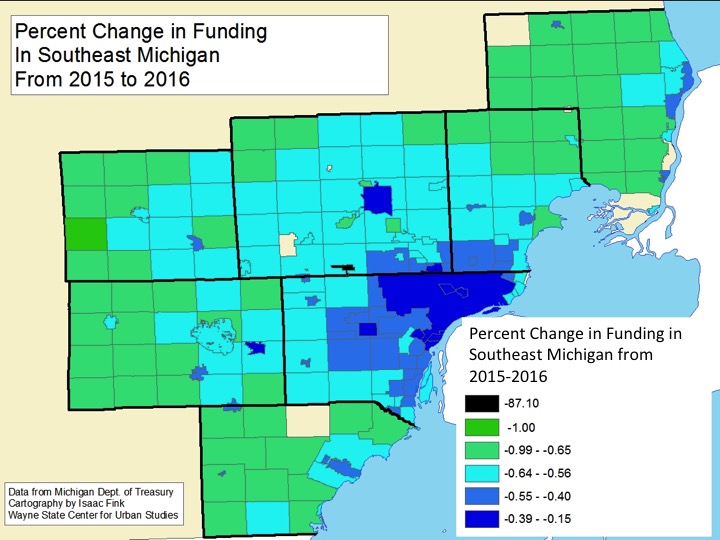

In Wayne County, the opposite was true when comparing the amount of funds distributed for 2006 and 2016; 81 percent of the municipalities in the region’s largest County experienced a decrease in the amount of Revenue Sharing Funds received. As noted, Detroit experienced one of the largest decreases, both in the county and in the region. It was Highland Park though that experienced the overall largest decrease in Wayne County, and the region, though. The funds Highland Park received in 2006 were 33 percent greater than what it received in 2016, without adjusting for inflation. When adjusting for inflation we see the decrease increase to about 39 percent. Other financially struggling communities, such as Ecorse an Inkster, also experienced a greater decrease in Revenue Sharing funds than many of their counterparts. Ecorse and Inkster both experienced a 25 percent decrease when comparing 2006 and 2016 funds, without adjusting for inflation. Also, it should be noted, Highland Park, Ecorse and Inkster were recipients of the FY 2016 $5 million Financially Distressed Cities, Villages and Townships Grant Program. Without being recipients of this grant the decrease in Revenue Sharing would have been greater for them.

Macomb Township is a notable community that has experienced Revenue Sharing Fund increases. Without adjusting for inflation this growing Macomb County township experienced a 77 percent increase when comparing 2006 and 2016 funds. In 2000 the township had a population of 50,478 and in 2010 that number was 79,580.

In order to better understand the shift in payment distribution below are the Constitutional and Statutory formulas for 2006 and 2016. Also presented is how we calculated in the inflation rate to best show how 2006 Revenue Sharing payments compare to those made in 2016.

Total Revenue Sharing Formula=Constitutional Payment + Statutory Payment

2006

Constitutional Revenue Sharing Example:

For the 2006 Constitutional Revenue Sharing the distribution rate was 68.6619. For a municipalities’ total annual Constitutional Revenue Sharing payment to be calculated, the total rate is multiplied by the 2000 population for each city, village and township.

- 2006 Statutory Revenue Sharing Payment=2000 population X 68.6619

- 2006 Detroit Constitutional Revenue Sharing Payment of $65,176,004 = 949,231 X 68.6619

Statutory Revenue Sharing Example:

The Statutory Revenue Sharing Formula for 2006 is based on the previous year’s Statutory Revenue Sharing funds. For 2006, the formula states that a municipality will receive about 99 percent of the Statutory Revenue Sharing Funds it received in 2005.

- 2006 Statutory Revenue Sharing Payment=2005 Statutory Revenue Sharing payment x 86467

- 2006 Detroit Statutory Payment= $220,151,807 x .9886467=$217,652,357

- Actual Statutory Funds Distributed in 2006: $215,898,144

***When using the formulas Detroit should have received $282,828,361 in total Revenue Sharing Funds in 2006, instead it received $281,074,148. According to the Michigan Department of Treasury, the amount of funds distributed is based on actual revenues received by the State and the State’s budget. This could, at least in part, explain the difference in funds received and funds expected.

2016

Constitutional Revenue Sharing Example:

For the 2016 Constitutional Revenue Sharing the distribution rate was 75.694800 For a municipalities’ total annual Constitutional Revenue Sharing payment to calculated, the total rate is multiplied by the 2010 population for each city, village and township.

- 2016 Constitutional Revenue Sharing Payment= 2010 Population x 75.6984

- 2016 Detroit Constitutional Revenue Sharing Payment of $53,939,054= 712,552 x 75.698400

Statutory Revenue Sharing Example:

The 2016 Statutory Revenue Sharing Formula is based off the amount of Statutory funds a municipality received in 2010, along with their compliance with Accountability measures. If these requirements were, met a municipality was eligible to receive up to 78.51044 percent of their 2010 total statutory payment, or a payment equal to the population multiplied by $2.64659-whichever was greater. The formula for 2010 statutory payments was the total amount a municipality received in FY 2009 multiplied by 88.94 percent, less the FY 2010 Constitutional amount, multiplied by the FY 2010 statutory payment percentage, according to the Michigan Department of Treasury.

- 2016 Statutory Revenue Sharing Payment=2010 Statutory Revenue Sharing payment x .7851044 (max eligible percentage of 2010 Statutory Payment)

- 2016 Detroit Statutory Payment= $178,910,540 x .7851044=$140,463,452

Inflation Adjustment

To better compare the 2006 Revenue Sharing Funds distributed versus the 2016 Revenue Sharing funds we applied the Consumer Price Index inflation rate of 19.5 percent.

2006 Constitutional Revenue Sharing Inflation Adjustment Example

- Adjusting for inflation= 2000 population X [(68.6619 X .1950)+ 68.6619]

- Adjusting for inflation= 949,231 X [(68.6619 X .195) + 68.6619 ]= $77,885,324

2006 Statutory Revenue Sharing Inflation Adjustment Example:

- Adjusting for inflation=2005 Statutory Revenue Sharing payment x [(.9886467 x .195) + .988647]

- Adjusting for inflation=$220,151,807x [(.9886467 x .195) + .988647] =$260,094,567

Overall, we see that some of Michigan’s most finically hit cities have experienced the greatest decline in state funding. While population does play an evident role in the amount of Revenue Sharing funds a community receives, we also know that Statutory Revenue Sharing Funds are diverted from the local municipalities to instead support the state budget. In addition, while at first glance distribution rates for the Constitutional Revenue Sharing may appear larger now than in the past, these rates do not account for inflation. For example, the 2006 Constitutional Distribution Rate of 66.6619 is equivalent to 82.0509 when adjust for inflation in 2016; this is about seven points higher than the actual 2016 Constitutional Distribution Rate. This further demonstrates how communities throughout Southeastern Michigan, and the state as a whole, have been experiencing a loss in Revenue Sharing Funds.