As of 10 p.m. on Monday June 26, some places in Michigan had Air Quality Index (AQI) levels above 150, a level that is serious for even healthy people and can be dangerous for people with serious health conditions, according to PurpleAir.com. This website tracks hyperlocal quality throughout the country on a daily basis; to view current information click here.

The poor air quality in Michigan, currently, is a result of massive fires in Canada, particularly Quebec, with smoke drifting down into Michigan.

But Michigan is also facing a substantial increase in wildfires of its own. And it could get worse.

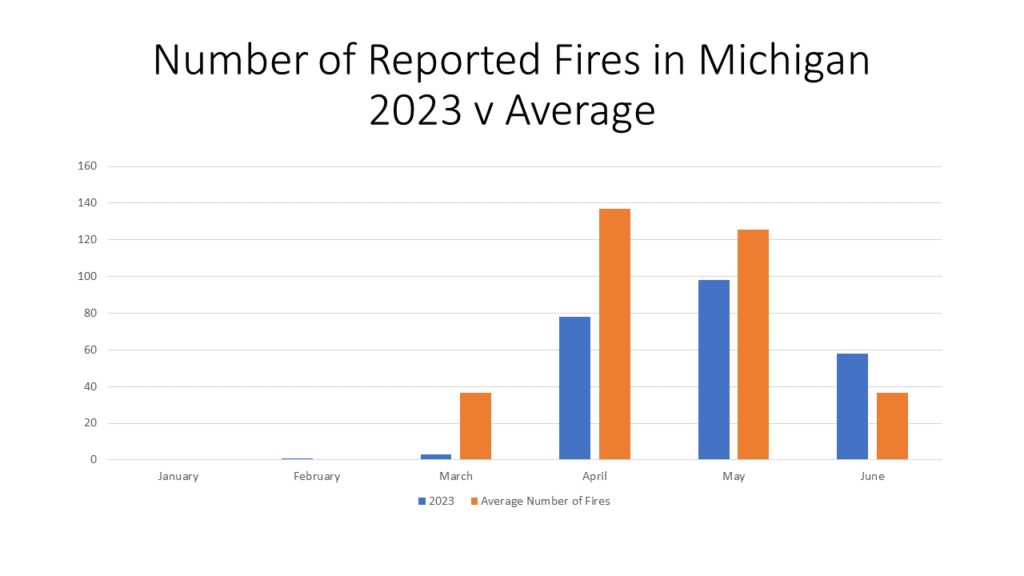

The average number of fires per year in Michigan is 337, according the Michigan DNR, and halfway through 2023 the state is on pace to exceed that average with 238 fires having already been reported. According to the Michigan Department of Natural Resources there have been 205 total fires in Michigan’s lower peninsula in 2023, as of June 26, 2023, and 33 in the upper peninsula.

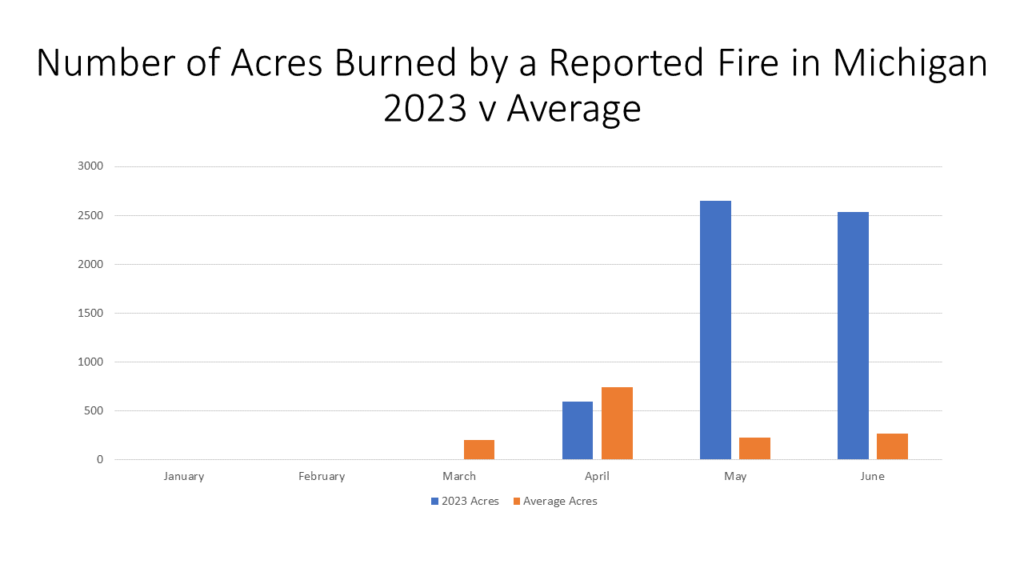

There are several reasons for fires, which include everything from lightening (279 since 2006) to fireworks (53 since 2006) to debris burning (1553 since 2006) and more. But one common factor amongst many fires is a dry environment that allows sparks to turn into flames and flames, in some cases, into raging fires. As of June 26 of this year, 2,532 acres of land had been burned by fires in Michigan; the average number of acres burned by fires in Michigan in June is 270. The Wilderness Fire Trail in Crawford County, which was started by a bonfire, burned more than 2,000 acres of land in June, according to the Associated Press. This wildfire contributed to the above average number of acres burned by fire in 2023. Michigan wildfires also drew attention in May, with more than three dozen being reported, according to Bridge Magazine. The cause? Drier than usual weather. According to the National Integrated Drought Information System, May of 2023 was the ninth-driest May in Michigan since the federal government began keeping records in 1895.

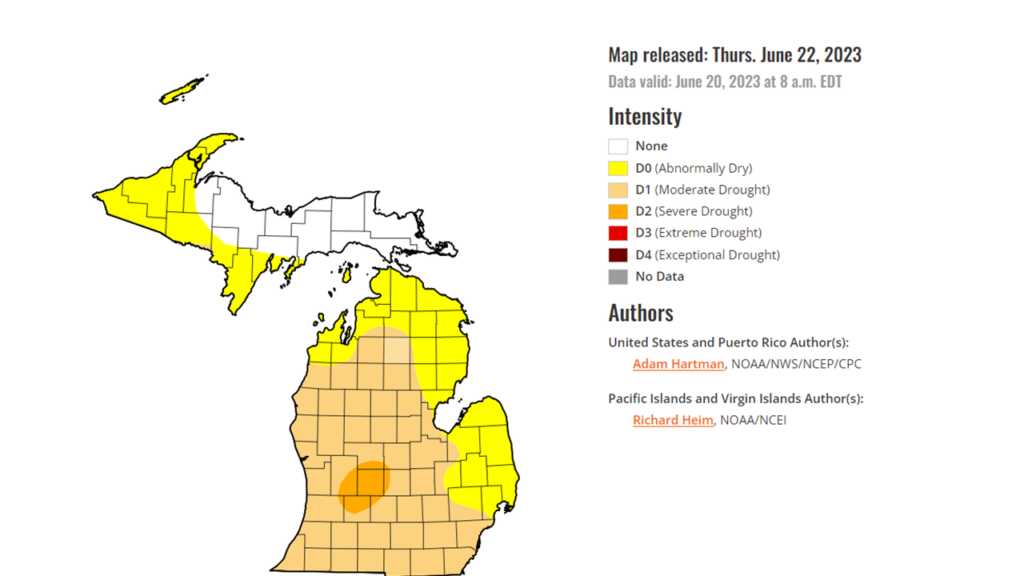

With summer just beginning, we are nowhere near being out of fire season. According to the US Drought Monitor, created by the University of Nebraska-Lincoln, much of Michigan is at least abnormally dry, as of June 22, 2023. The western portion of the Upper Peninsula and about a third of the Lower Peninsula (the thumb and the top of the “mitten”) have been deemed “abnormally dry,” and nearly all the remaining portion of the “mitten” (including Wayne County) have been deemed “moderately dry.” There is also an area in mid-Michigan that has been deemed to be in a severe drought; the eastern portion of the Lower Peninsula has no drought conditions.

With drier conditions being a factor in increased fires across the state of Michigan, we must also touch on what is behind the drier conditions. Climate change, driven by increased emissions, pollution and more, can be dubbed as the main culprit behind increased drought conditions in certain areas (and increased drought in other areas, but that is for another day).

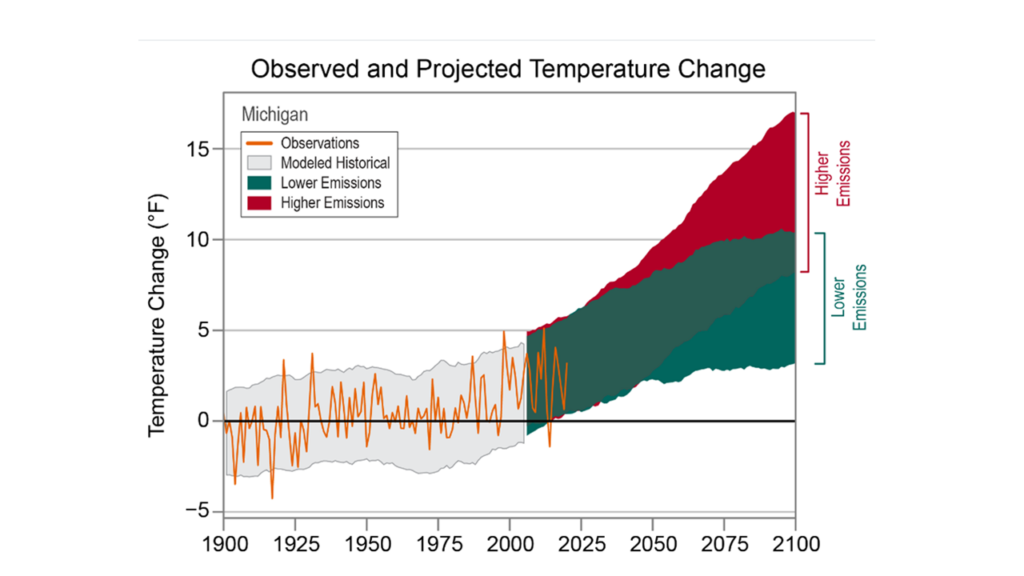

In Michigan, average temperatures have already risen 2.5 degrees, with summers being hotter and heatwaves being stronger. Fast forward to 2100, summers in Isle Royale National Park, for example, are expected to be 11 degrees hotter, according to statesatrisk.org.

The chart below shows just how Michigan’s annual daily temperatures have changed since 1900 and how they are expected to change up to 2100, depending on the amount of emissions we continue to pump into the environment (Southeast Michigan has several high emission emitters, as will be discussed in detail in a future post). The observed data is through 2020 and shows that Michigan’s average temperature has increased by nearly 3 degrees (Fahrenheit) over time. According to the data set from The Cooperative Institute for Satellite Earth System Studies and the National Oceanic and Atmospheric Administration (NOAA), even with lower emissions temperatures are expected to increase in Michigan by a minimum of 3 degrees through 2100. That number could increase to at least 12 degrees though if the emissions we produce increase.

With climate change having a direct impact on our environment, it is also having a direct impact on our lives. We know drought can be catastrophic to crops, our food systems and the economy and we know fires cause destruction. It should also be known that fires also have a direct impact on air quality, which affects the lives of all of us.

Next week we will dig into how Michigan’s air quality ranks and how the fires in Michigan, and beyond, have making it much worse in recent weeks.