With majority of the housing units in the region are reported to have a mortgage, it is important to understand what cost of mortgages are for homeowners. In this post we examine the median monthly housing cost for homeowners with and without a mortgage, along with what percentage of a homeowner’s income the mortgage makes up.

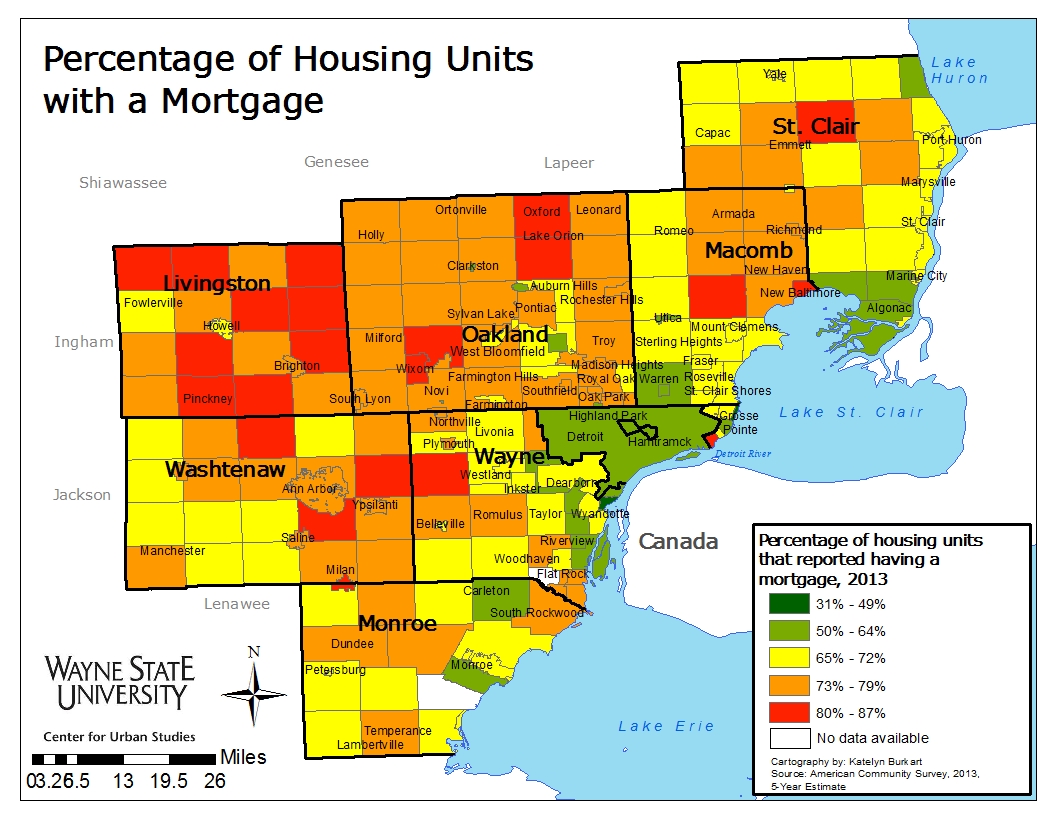

There were 22 communities out of 227 in Southeastern Michigan where more than 80 percent of the housing units reported having a mortgage according to the American Community Survey 5-year estimates for 2013. While this is only equivalent to about 10 percent of the region, it should be noted that many of these areas also have some of the newest housing units .

In the majority of the communities in the region 65 percent or more of the housing units were mortgaged. Detroit was on the low end of this spectrum with 51.1 percent of housing units having a mortgage. There was a handful of communities near Detroit where less than 60 percent of the owners reported having a mortgage. In addition, there were two in Monroe County and five in St. Clair County that were reported to be below 60 percent.

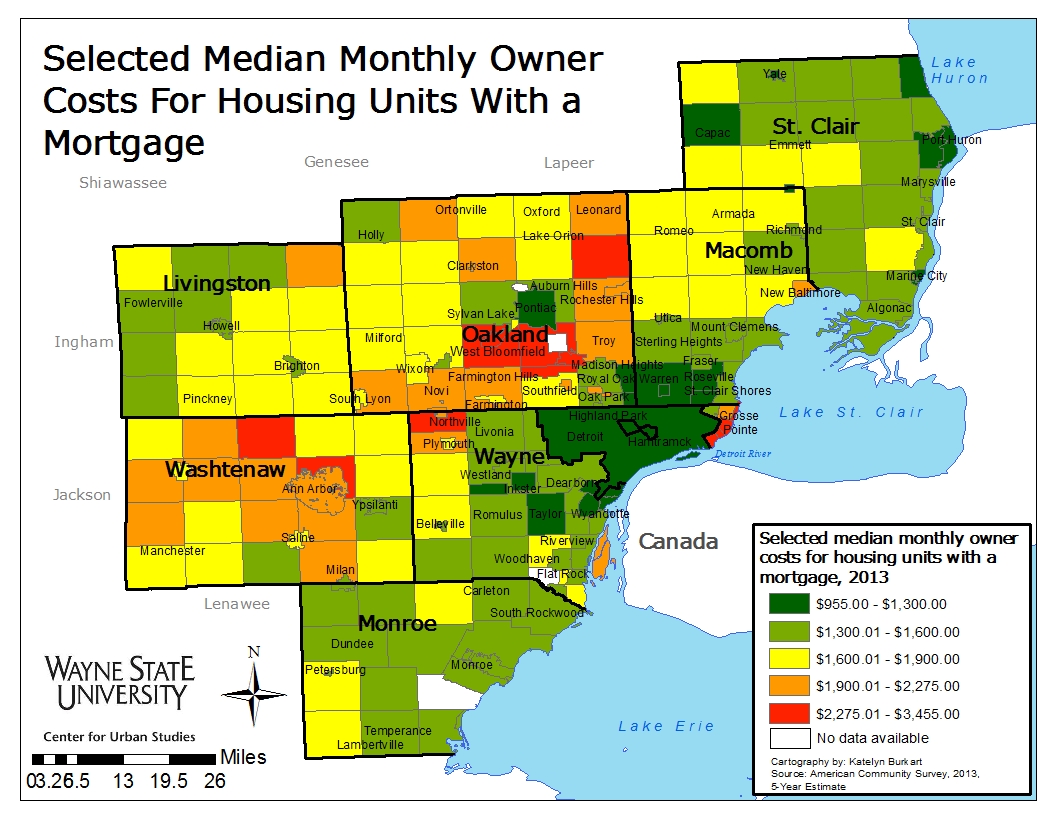

There are groups of households who have mortgage costs three or more times higher than households with the lowest cost mortgages. As one might expect, the highest median monthly owner costs for mortgaged housing units were located in the communities with some of the highest median incomes (link to past post). Those communities with the highest monthly owner housing unit cost were:

- Bloomfield Hills: $4,000+

- Northville: $2,478

- Webster Township: $2,289

- West Bloomfield: $2,200

- Grosse Pointe Farms: $2,189

- Grosse Ile: $2,126

- Addison Township: $1,749

- Ann Arbor Township: $1,540

Most of the region, though, had median costs ranging between $1,300.01 and $1,900.

Detroit was only one of 18 other communities in the region where the median monthly cost was $1,300 or below. Pontiac was the only community in Oakland County in this category, and there were none in Livingston, Monroe, or Washtenaw counties.

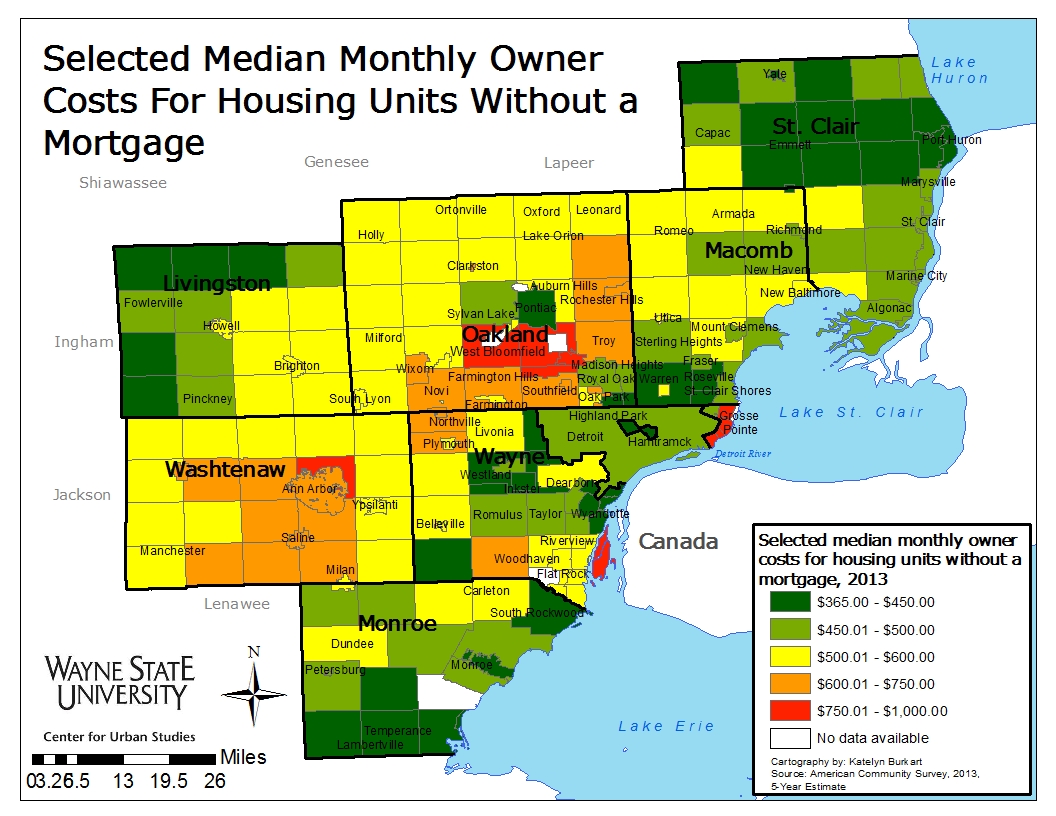

Homeowners actually have substantial costs above and beyond their mortgage. The Census Bureau includes: the U.S. Census bureau includes the sum of real estate taxes, various insurance costs, utilities, fuels, mobile home costs and condominium fees. The monthly median housing cost for units without a mortgage are notably smaller, ranging between $365 and $1,000. Additionally, many of the same communities with high median monthly housing unit costs with a mortgage also had high median monthly housing unit costs without a mortgage.

Homeowners actually have substantial costs above and beyond their mortgage. The Census Bureau includes: the U.S. Census bureau includes the sum of real estate taxes, various insurance costs, utilities, fuels, mobile home costs and condominium fees. The monthly median housing cost for units without a mortgage are notably smaller, ranging between $365 and $1,000. Additionally, many of the same communities with high median monthly housing unit costs with a mortgage also had high median monthly housing unit costs without a mortgage.

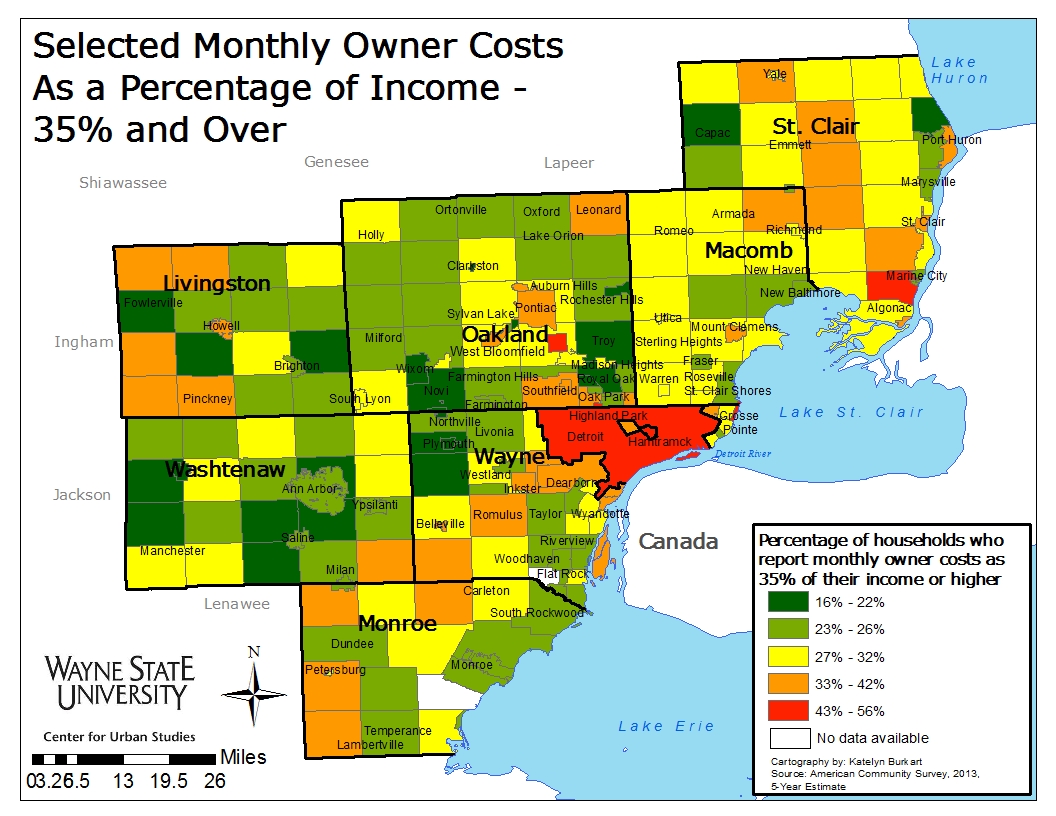

In the city of Detroit, about 65 percent of homeowners reported selected monthly owner costs (mortgage, taxes, utilities) between $700 and $1,499. These housing costs took up between 32 percent and 68 percent of the average Detroiter’s income, which was $26,325 in 2013. This is why more than 43 percent of Detroiter’s with a mortgage reported that it took up more than 35 percent of their income.

Only Marine City, Hamtramck and Bloomfield Hills also had more than 43 percent of their homeowners report that 35 percent or more of their income went to monthly owner costs.

In general many of the highest income communities had some of the lowest overall housing costs relative to income.

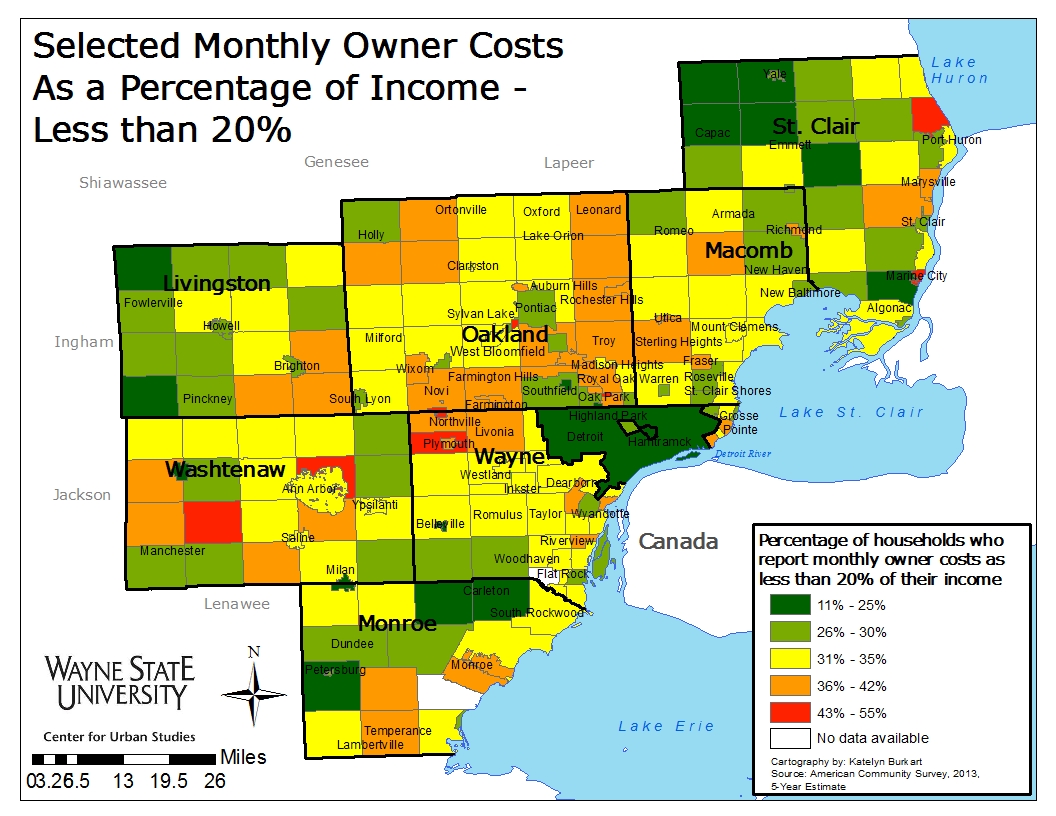

Effectively this is inverse of the previous map. Here we show the percent of homeowners who are paying less than 20 percent of their income for housing costs. There are five communities where more than 43 percent of homeowners reported their monthly housing costs to be less than 20 percent of their income. Many of these are, again, higher income communities. Some, however, including, Marine City, Port Huron, Plymouth and Ann Arbor are among the communities with the oldest housing stock, meaning that while their utility fees and taxes may not have decreased since the house was built, the mortgages could have been paid off by some of the owners due to the extended time they have owned the home.