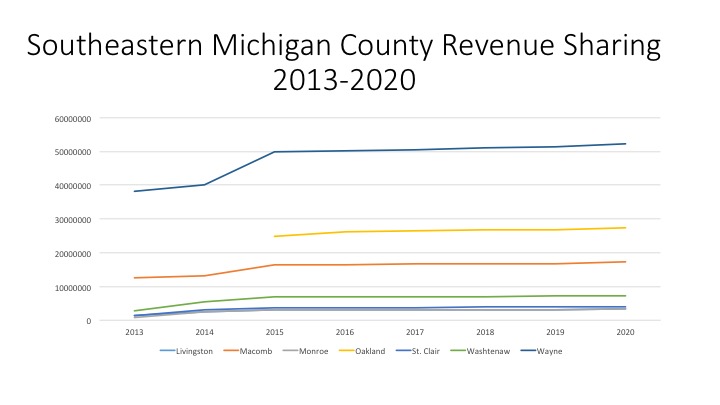

The State of Michigan has consistently disinvested in local government by providing less and less in revenue sharing. Cities, townships, villages and counties all rely on this funding to address there budget needs. But, since 2002 the State has withheld more than $8 billion. We have discussed the loss of revenue sharing-both constitutional and statutory-for the local municipalities, however we have not explored revenue sharing at the county level. Unlike cities, townships and villages, counties do not receive constitutional revenue sharing but rather only statutory revenue sharing. The chart below shows data from the Department of Treasury, which reported on the amount of revenue sharing each county received since 2013. The 2020 number below is the expected amount each county is to receive for fiscal year 2020.

According to the State Revenue Sharing Act of 1971 counties are to receive between 21 and 25 percent of sales tax revenue at the 4 percent rate. That changed for a short period of time when in Fiscal Year 2004-05 revenue sharing payments to counties were temporarily suspended. At that time counties were required to create a reserve fund with their own general fund dollars; counties were then allowed to withdrawal funds in lieu of the state revenue sharing funds that were not being dispersed, according to the Senate Fiscal Agency. Once a county exhausted its reserve fund then it could again become eligible for state revenue sharing funds. To add to that, in 2013 counties also became eligible for County Incentive Program Funds; 20 percent of a counties revenue sharing was based on eligibility in this program. These funds are allocated if a county meets certain transparency and accountability standards set by the State.

As the chart shows above, there has not been a serious increase in county revenue sharing since 2015, and between 2014 and 2015 Wayne County received the largest increase of about $10 million. This increase did not come from the County Incentive Program Funds, which accounted for about $10 million in 2014 and 2015, but from its statutory funding. In 2014 Wayne County received about $40 million in revenue sharing and in 2015 that increased to about $50 million. For Fiscal Year 2020 Wayne County it was proposed Wayne County receive about $52 million in revenue sharing, a small increase from its $50 million appropriation in 2015. In 2020 Wayne County’s revenue sharing payment is to be eligible to be $42 million from statutory funding and $10 million from the County Incentive Program.

Another item to note is how Oakland County did not receive revenue sharing in 2013 and 2014. According to the data Oakland County was not eligible for any type of revenue sharing funding in either year. Although no specific information was available as to why, it could have been that the County used its reserve funds by 2013 and was not eligible for restored funding from the State until 2015.

One of the components of revenue sharing formulas is population, which is reflected in the amount of funding each county received in the chart above. Wayne County has the largest population, which is why it has consistently received the highest amount of funding and counties like Monroe and St. Clair or more rural with more lower populations and lower funding amounts.

Overall, the chart above show how revenue sharing for counties in Southeastern Michigan (and at a greater level, across the state) has remained stagnant for several years. The stagnation, and loss, of revenue sharing funds directly impacts that services a county provides. According to the Michigan Association of Counties, counties have lost $2.4 billion in revenue sharing funds. Additionally, in 2019, cities, townships and villages received more than $1 billion total in both constitutional and statutory revenue sharing funds and counties received $221 million in statutory funding. We will also look