Ozone action season is upon us here in Southeast Michigan; it began March 1 and continues through the end of September. Ozone Action Days are declared when hot temperatures are expected to combine with pollution, creating high amounts of ground-level ozone. Ground level ozone, especially in excess, can cause a human health threat, particularly to vulnerable population. These vulnerable populations include children, those 65 years of age or older, those with asthma, COPD, cardiovascular disease, lung cancer and those who are pregnant.

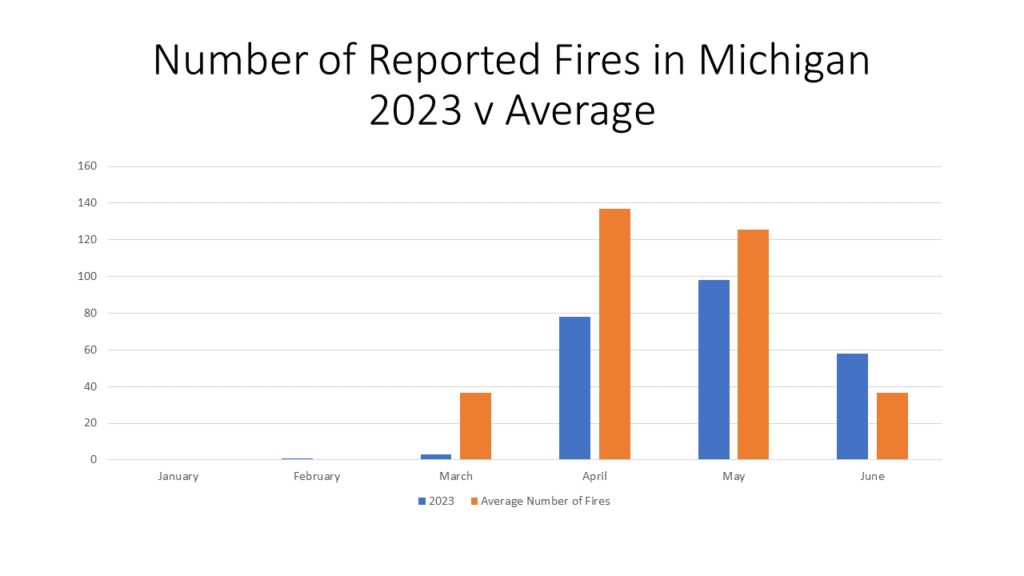

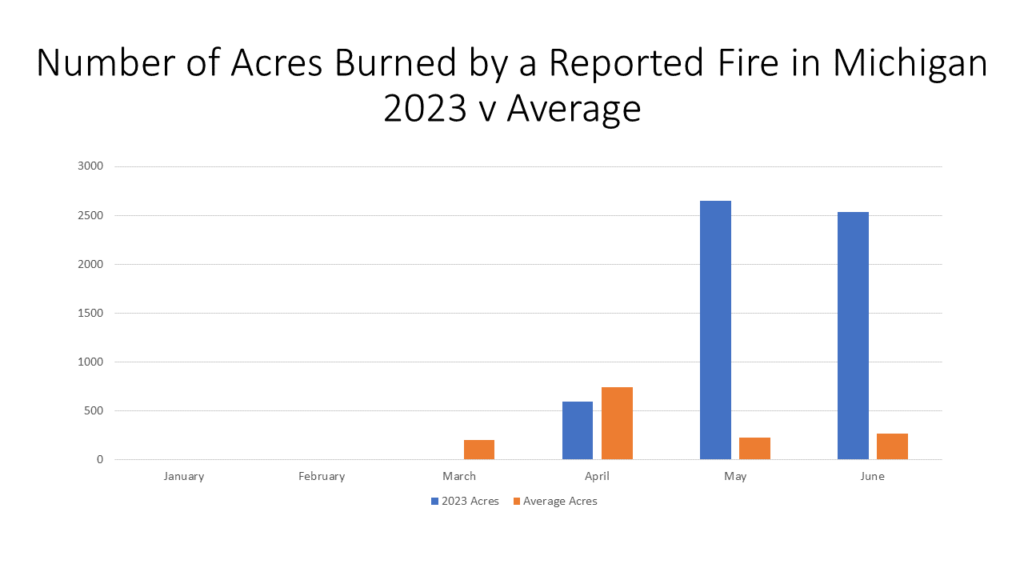

In 2022 in Southeast Michigan there were five Ozone Action Days, according to the Southeast Michigan Council of Governments, or days when the public is asked to do less strenuous activities and to reduce the ways in which they may contribute to air pollution. While we were certainly hoping for zero Ozone Action Days in 2023, we have already had 14, due in large part to the smoke that has drifted to Southeast Michigan from the Canadian and Northern Michigan wildfires. The most recent Ozone Action Day in Southeast Michigan was declared on July 5, 2023 and the first of the season was declared on April 15, 2023.

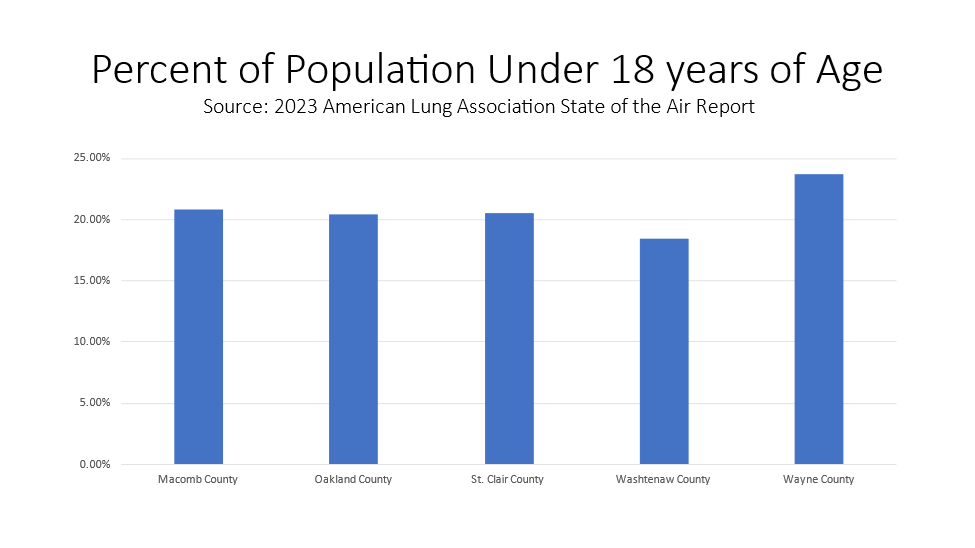

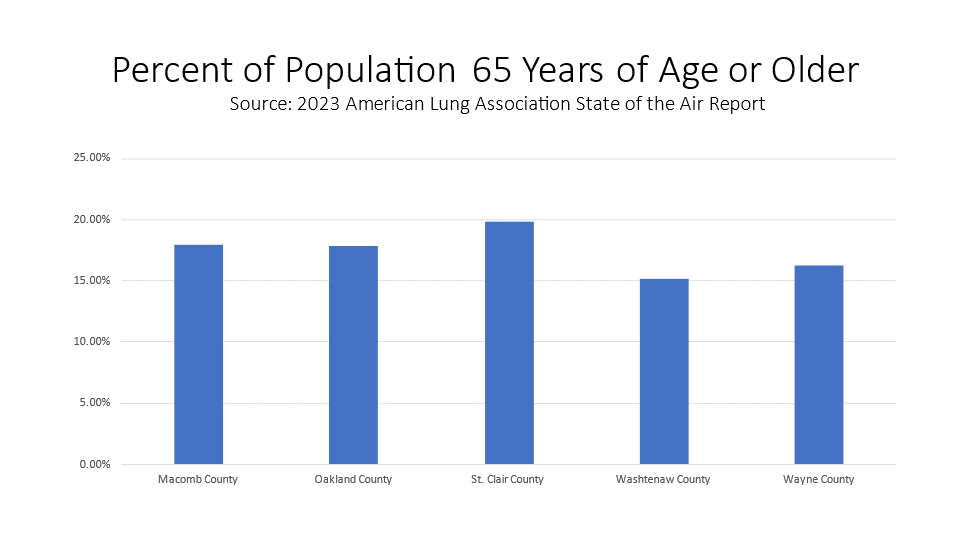

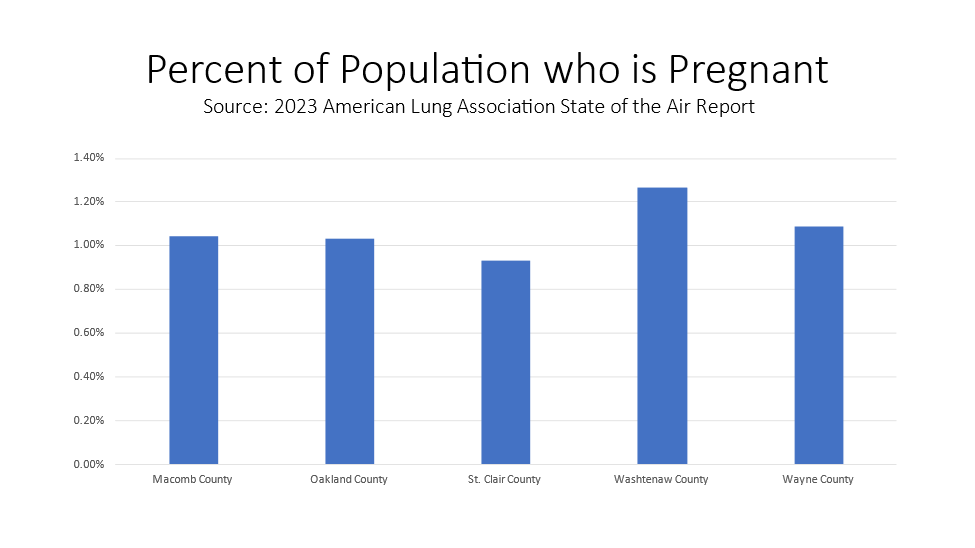

With nearly triple the number of Ozone Action Days in 2023 compared to 2022, concerns of air quality remain a constant worry throughout Michigan, as does the population’s health, particularly our most vulnerable populations’. Each year the American Lung Association releases a State of the Air Report that examines air quality at the county, state and national levels and how it impacts certain populations. For the 2023 State of the Air Report, The American Lung Association had data on the vulnerable populations of Macomb, Oakland, St. Clair, Washtenaw and Wayne counties.

As the data shows, children (those under the age of 18) are the category with the highest percentage of individuals at risk. Of the five counties with such data available from the American Lung Association, between 18 and 24 percent of the populations are children, with Wayne County having the highest percentage and Washtenaw County having the lowest percent. The category of those 65 years of age or above had the second highest percentage of individuals at risk, with between 15 (Washtenaw County) and 19 percent (St. Clair County) of the population being at risk of health complications from high ground ozone levels.

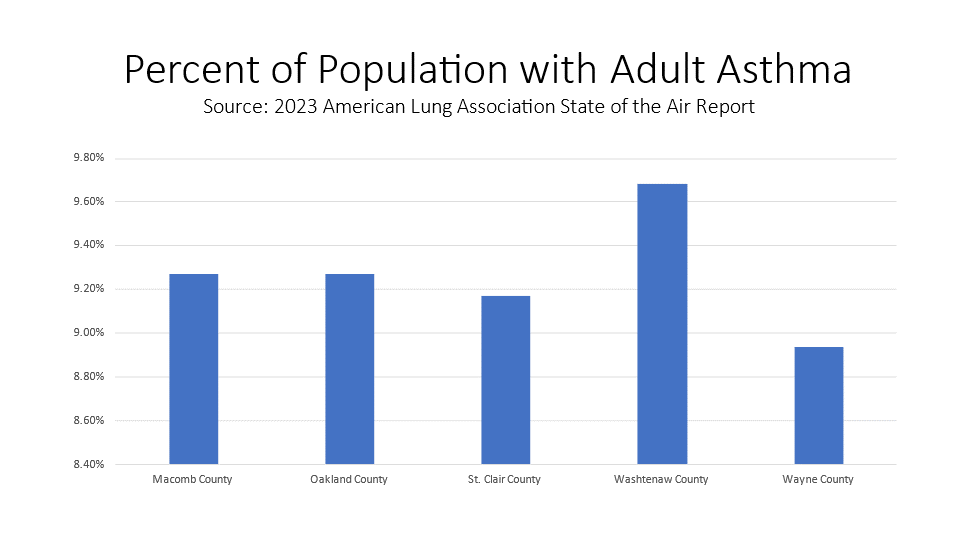

Of the diseases/conditions that can contribute to health problems during Ozone Action Days, adult asthma was the most common among the counties in Southeast Michigan (between 9-10 percent of the populations in the counties had adult asthma). Of the child population in the region, each of the five counties discussed in this post had 7 percent of that population with childhood asthma.

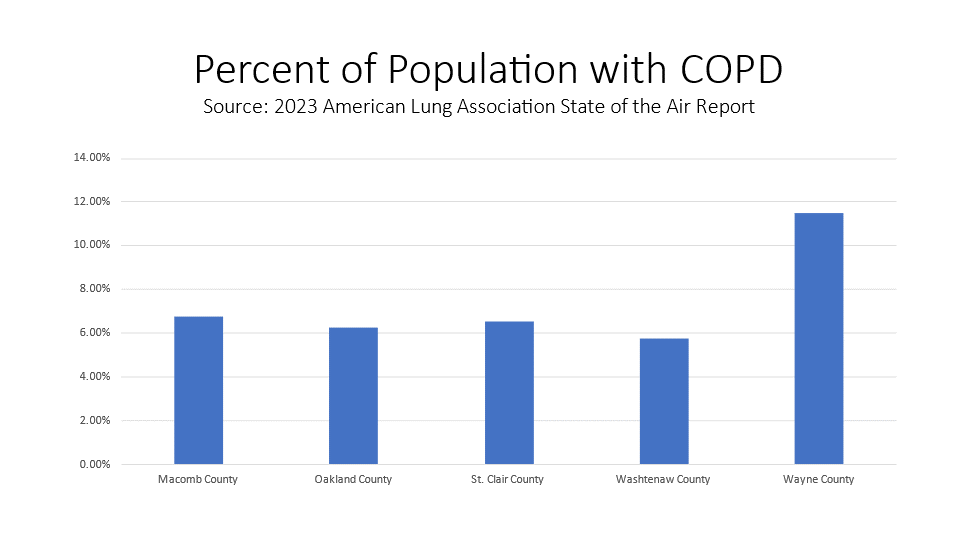

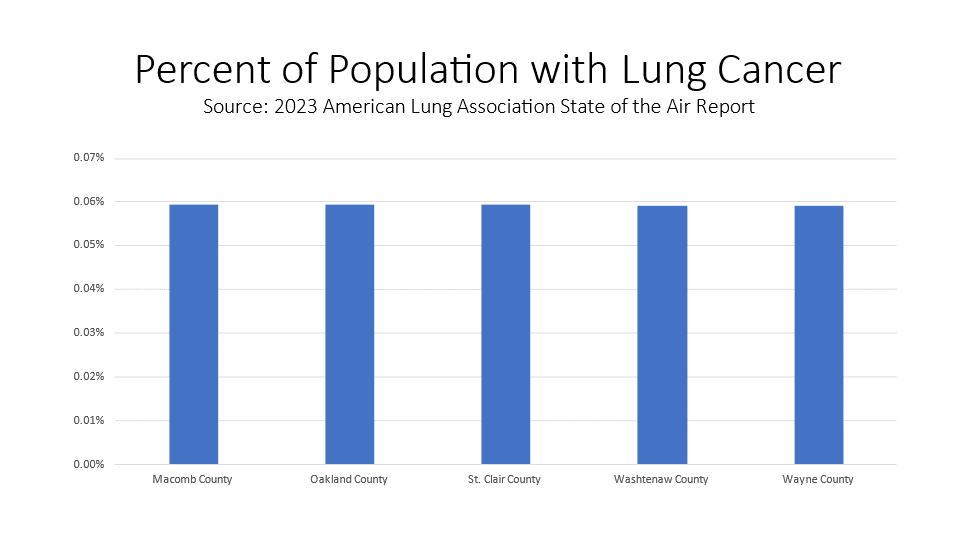

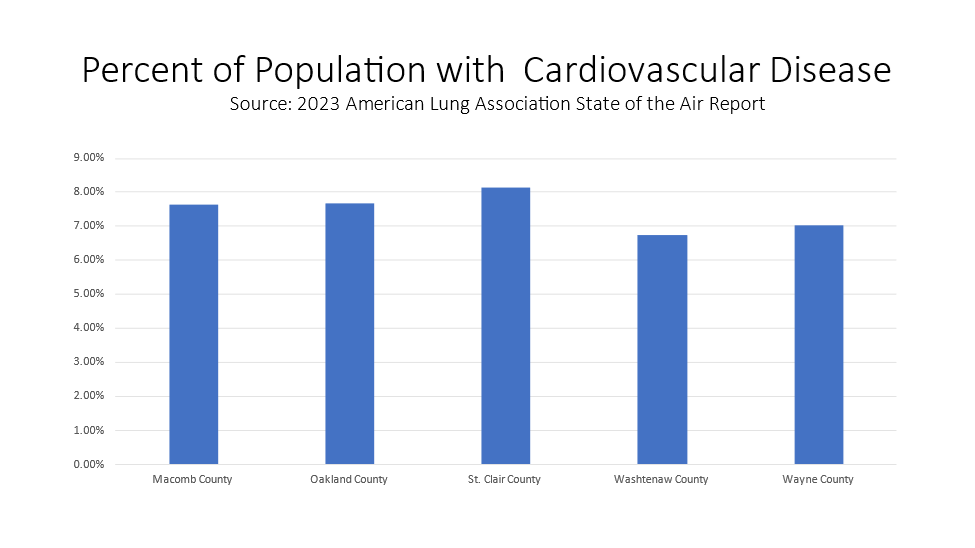

For COPD, less than 7 percent of the populations in Macomb, Oakland, St. Clair, Washtenaw and Wayne counties had the disease, except for Wayne County where the American Lung Association reported 11.5 percent of the population had COPD. Heart disease, lung cancer and being pregnant also cause increased health risks during high ozone days, and of those three categories heart disease had the highest percentage of individuals who could be impacted.

While we can’t control how and when wildfire smoke will drift through our region there are actions we can take to help lower the amount of particles in the air, in general, and especially during Ozone Action Days.

According to the Southeast Michigan Council of Governments, to help lower the amount of ground level ozone in the air we can:

- Delay mowing your lawn until evening or the next day. Exhaust from a lawn mower and other gas-powered lawn and garden equipment help form ozone.

- Drive less, telecommute, bike, or walk. This helps reduce traffic congestion and air pollution.

- Avoid refueling vehicles during daylight hours. Fumes released at the gas pump contribute to ozone formation.

- Delay or combine errands. This will reduce traffic congestion and air pollution.

- Reduce electricity use.

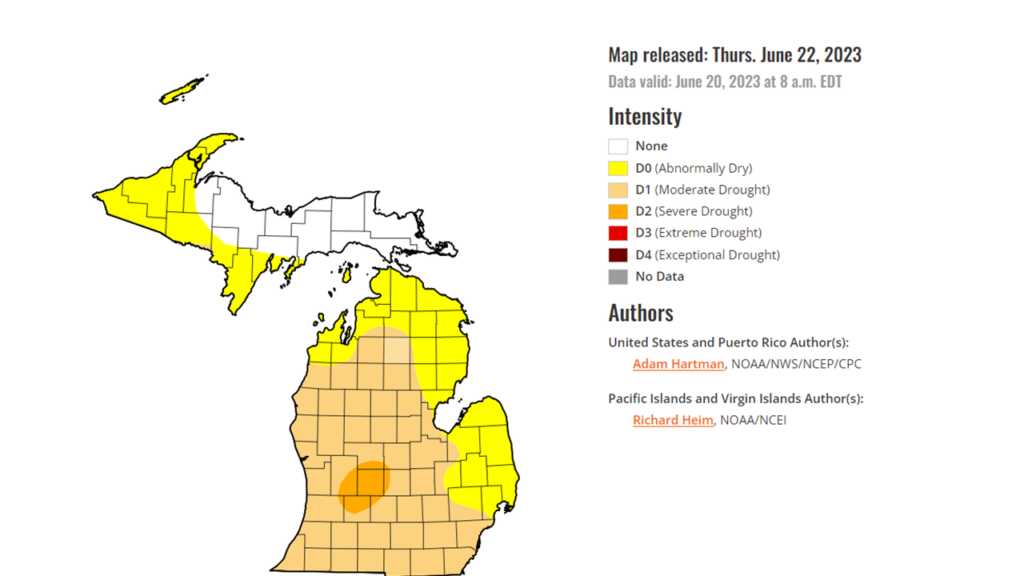

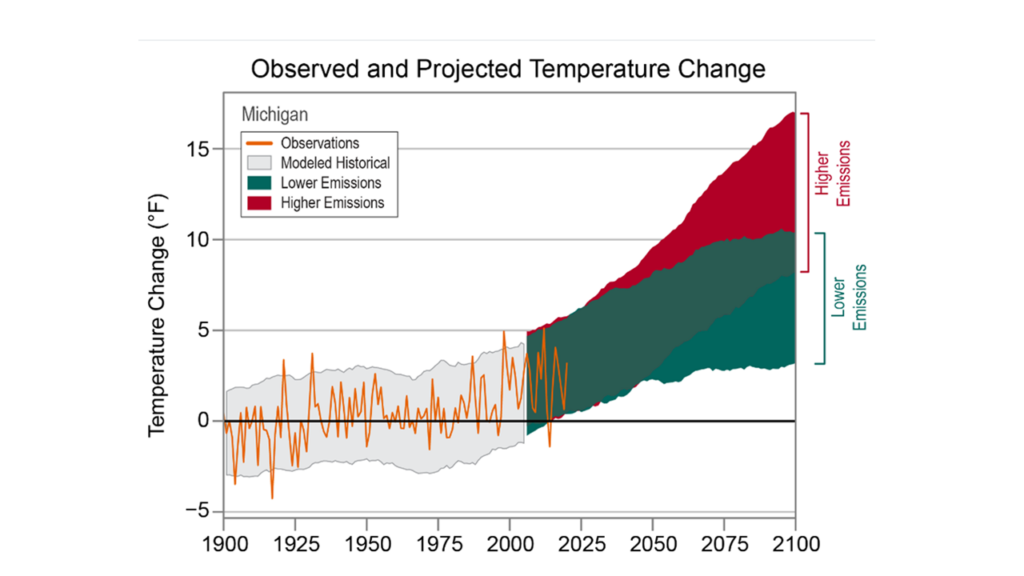

With wildfires still burning in Canada, temperatures continuing to rise and air pollution still occurring in Southeast Michigan, it is likely the number of Ozone Action Days in Southeast Michigan will rise from 13. For some of our most vulnerable populations, summer days may be spent inside more often than expected, now and in the future. As noted in our previous post, the wildfires causing our most recent Ozone Action Days are related to climate change, which is creating hotter and dryer seasons.

And, while wildfires are impacting our air quality, so is pollution, which also is a driving factor in climate change. Two of the vulnerable populations we did not discuss in this post are those in poverty and certain minorities. We will further examine how these populations are impacted by not only air quality, but also pollution, in future posts as we have a larger conversation on environmental racism.