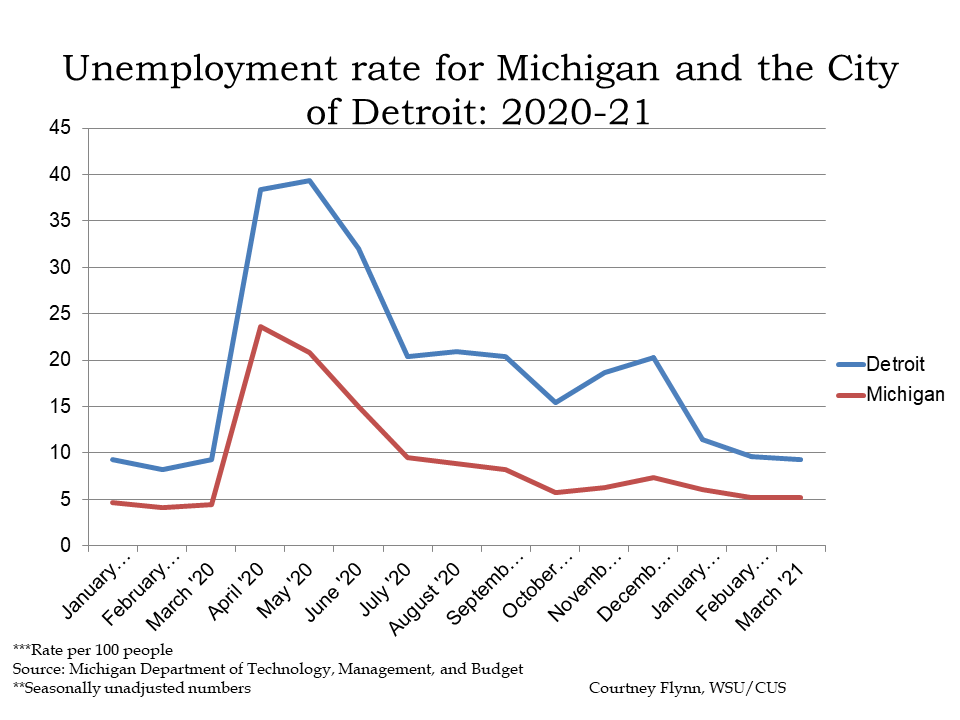

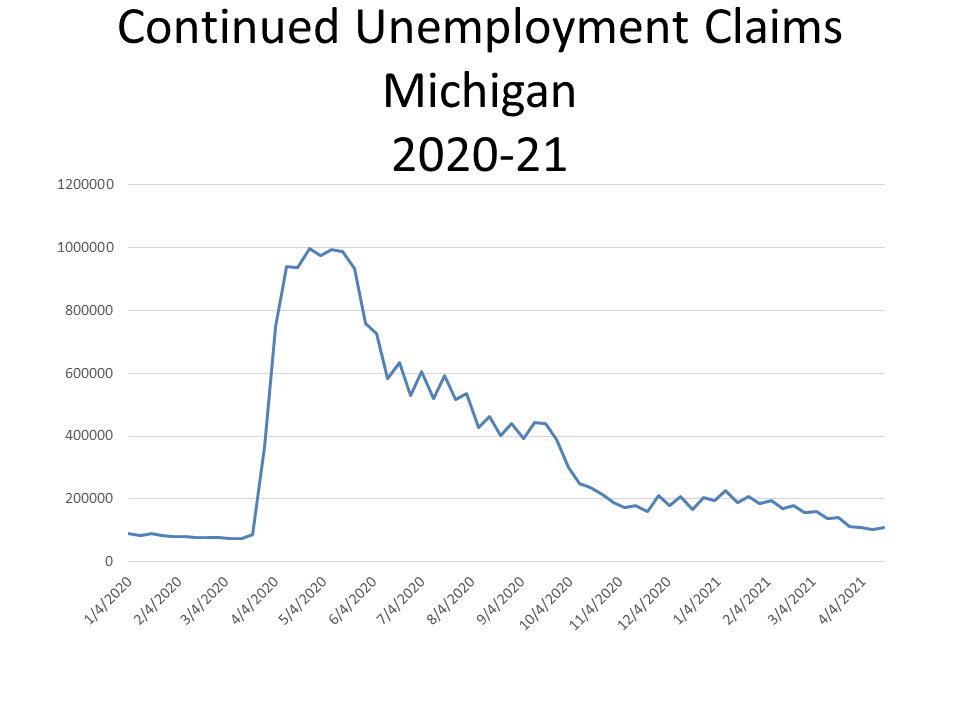

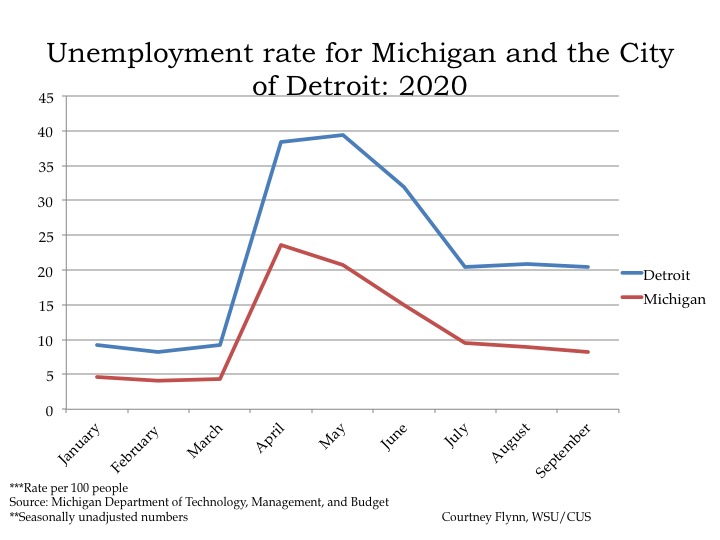

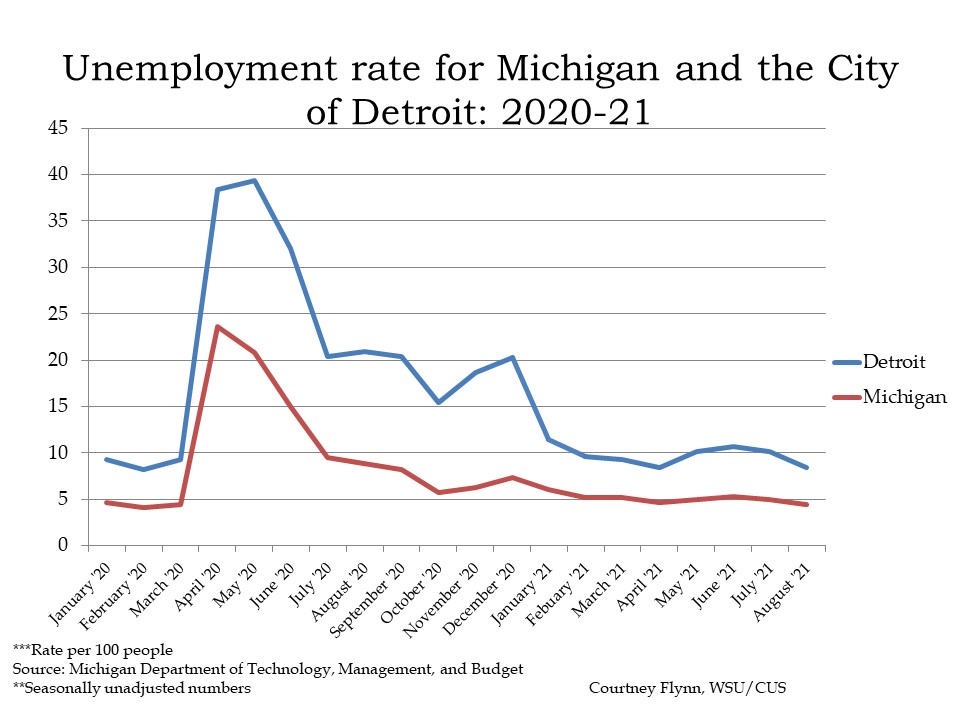

In August of 2021 the unemployment rates for the State of Michigan remained steady from the previous months while the City of Detroit’s unemployment rate took a dip, following a slight increase the month prior. The State of Michigan reported an unemployment rate of 4.4 in August, which was just below the 5 percent unemployment rate reported in July. Since January of 2021 the State’s unemployment rate has not gone above 6.1 percent.

For the City of Detroit, the unemployment rate for August of 2021 was 8.4 percent, which is 1.7 points lower than the July unemployment rate and 10.8 points lower than the August 2020 rate.

Both data sets show that the unemployment rates in Michigan and Detroit are stabilizing to pre-pandemic rates.

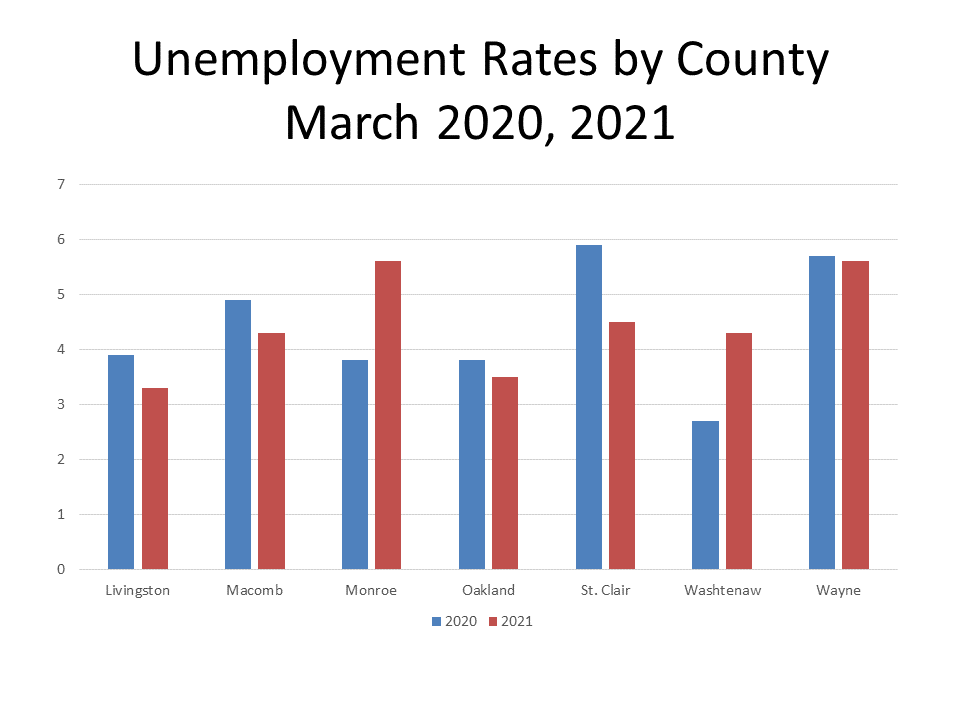

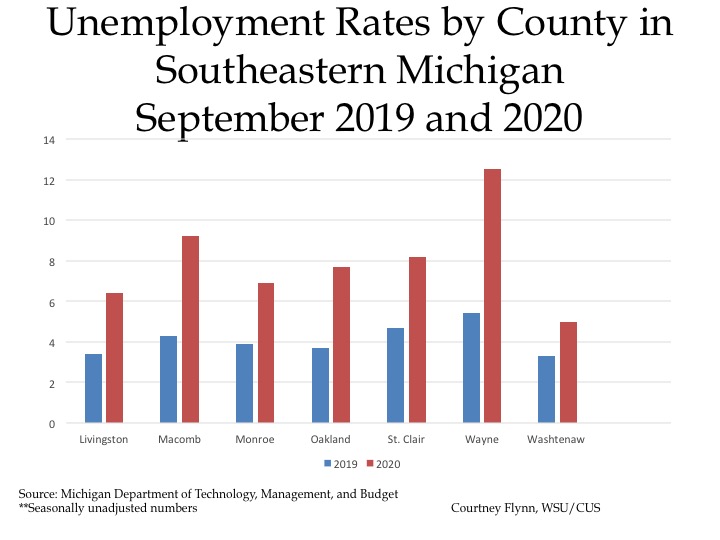

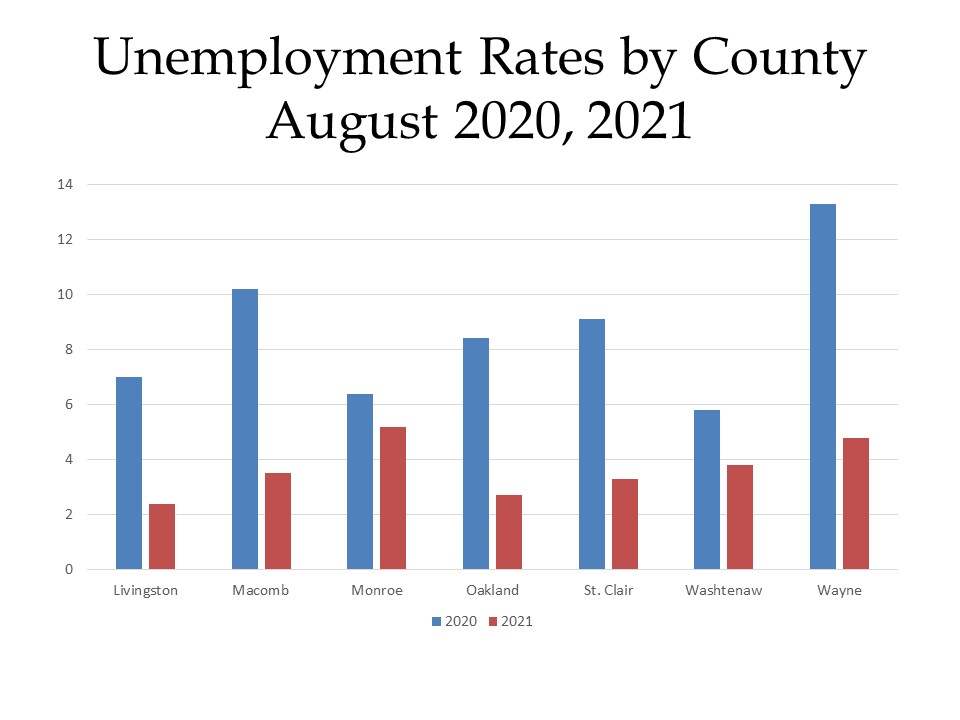

The chart above shows unemployment rates beginning to level off and the chart below shows a deeper story—just how drastically unemployment rates have dropped in a year. Each county in Southeastern Michigan experienced an unemployment rate decrease between August of 2020 and August of 2021, with Wayne County experiencing the largest decrease at 8.5 points. In August of 2020 Wayne County had an unemployment rate of 13.3 percent and in August of 2021 it decreased to 4.8 percent. Monroe County had the smallest change in the last year with it recording an unemployment rate of 6.4 percent in August of 2020 and a rate of 5.2 percent in August of 2021. In August of 2021, Monroe County also had the highest unemployment rate regionally. Livingston County reported the lowest unemployment rate in August of 2021 at 2.4 percent while Washtenaw County reported the lowest unemployment rate in August of 2020 at 5.8 percent.

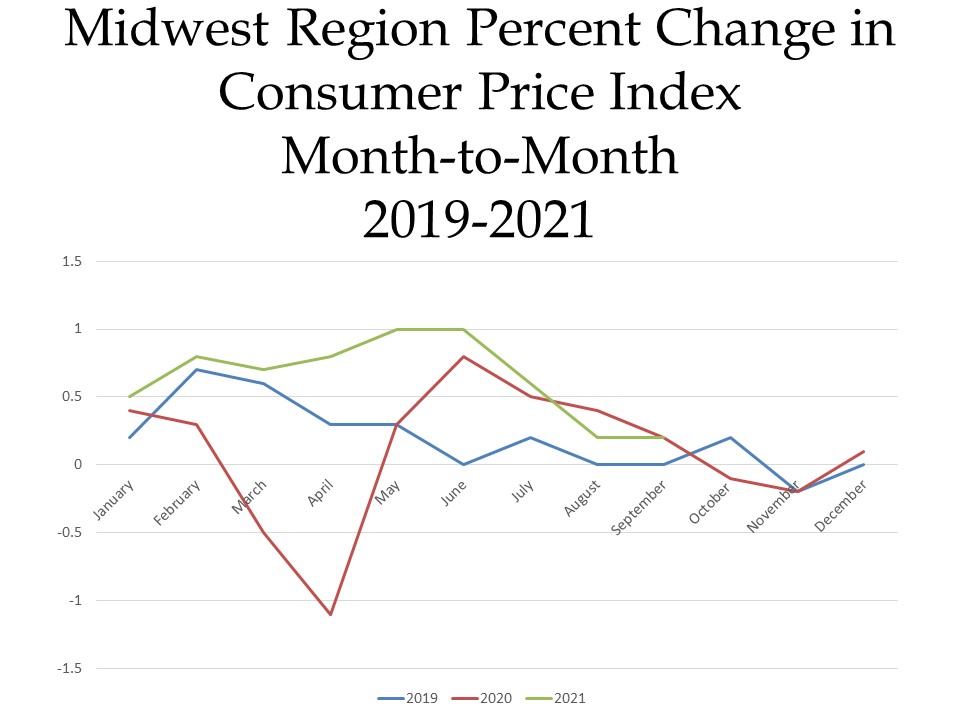

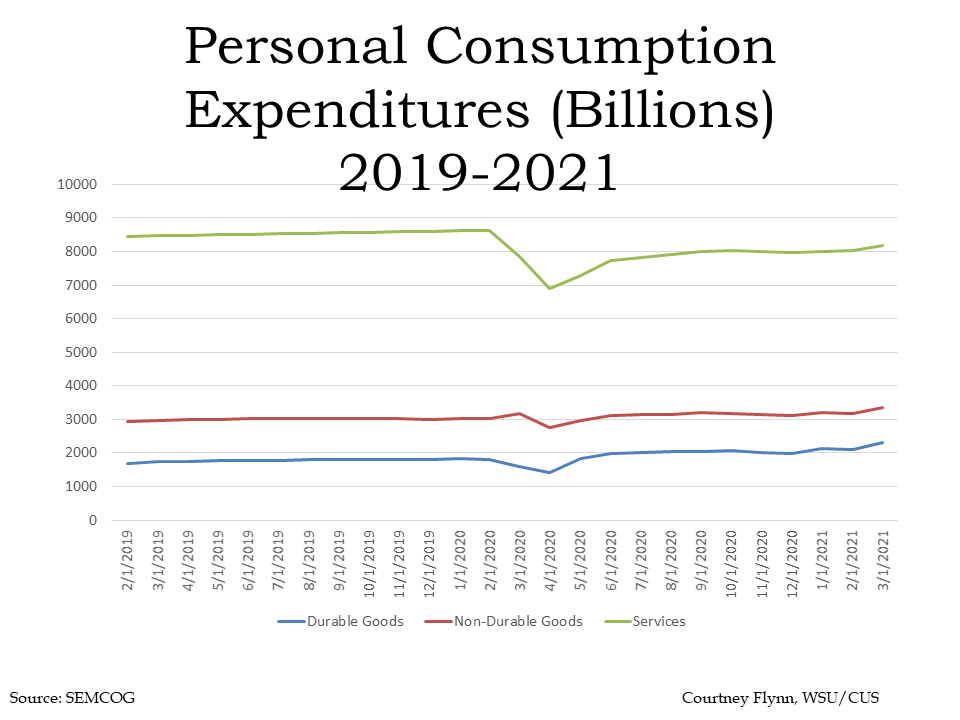

The first chart below highlights how the CPI changed on a month-to-month basis between 2019 and 2021. Prices in the Midwest region fell to their lowest in April of 2020, a -1.1 percent decline from the month prior; this was just as the pandemic was beginning. Just a month later though they increased by 0.8 percent. Currently in 2021, area prices are up 0.2 percent between August and September. According to the Bureau of Labor Statistics, food prices increased 1 percent between August and September of 2021, and energy prices increased 0.9 percent. Categories that were higher included shelter, apparel, household furnishings and operations.

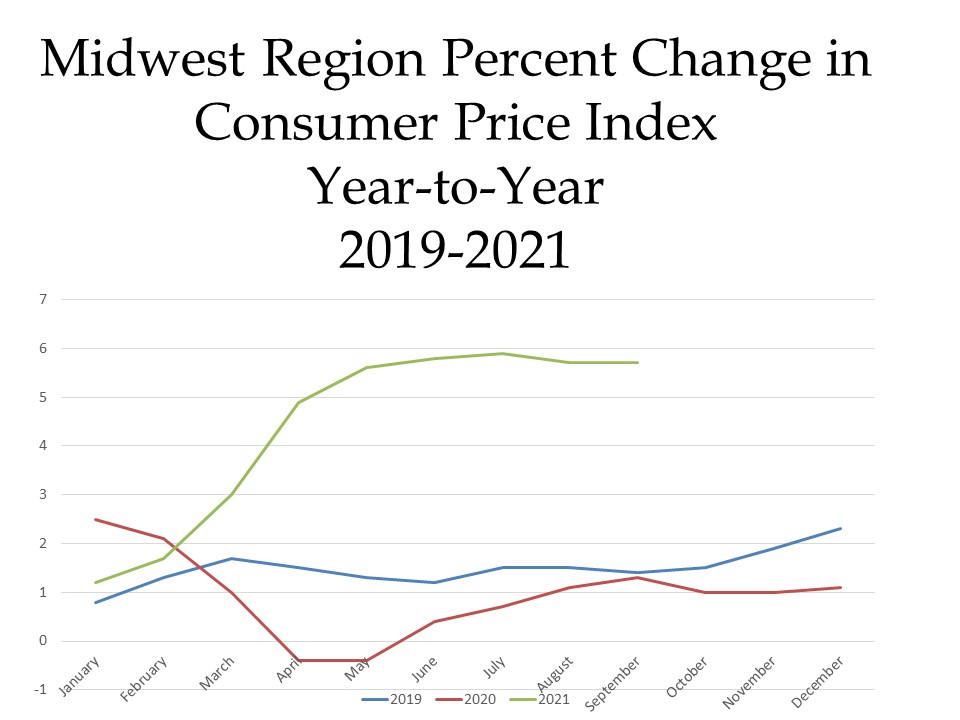

When examining the second chart, which shows how prices changed on a year-to-year basis, we see how prices in nearly the entire year of 2020 declined below what they were in 2019 (which was a fairly stable year) and how in 2021 the CPI has been lingering between about 5.5 and 5.9 percent since May. Of course, with the steep decline in 2020 due to the pandemic, we are likely to see a higher CPI in 2021 as everything begins to stabilize. However, some categories are experiencing rather large leaps. For example, in September of 2021 the CPI was up 5.7 percent from a year ago. One of the expenditures that has experienced a large increase in the CPI categories is gas services. Utility services are up 34.2 percent from a year ago and gasoline (motor fuel) is up 45.6 percent from a year ago. Under food and beverages, meats, poultry, fish and eggs experienced the highest increase at a 7.4 percent increase from a year ago, and housing experienced a 5.1 percent increase.